The Future of Funds: Analyzing Franklin Templeton's Tokenized Ventures on Polygon

In the traditional setting, the centralized bodies govern the behavior of these assets. For example, for sovereign debt governments issue bonds to raise funds for various purposes, such as infrastructure projects or financing budget deficits and investors purchase these bonds, effectively lending money to the government. The terms and conditions of these bonds, like interest rates, debt management, regulation, and issuance, are all controlled by the government itself.

Similarly, banks provide loans to individuals and businesses for purchasing real estate which are secured by the property itself and involve fixed or variable interest rates. Borrowers make regular payments to repay the principal and interest over the loan term. Mortgages can be securitized into mortgage-backed securities (MBS), which are then traded on financial markets.

This blog will provide an in-depth analysis of the gradual migration of traditional asset classes, such as sovereign debt, commercial and residential mortgages, and corporate loans, onto the blockchain. It highlights the benefits of this transition, including enhanced liquidity and reduced administrative overhead, explores how blockchain technology is reshaping the financial landscape, and discusses Franklin Templeton tokenized funds in-depth, using data from Bitquery.

In the context of this blog, it's essential to establish a clear understanding of the term RWA, which will be frequently referenced throughout our discussions. RWA stands for Real World Asset, which means something that in the current financial landscape falls under the control of traditional financial institutions like Banks or Government, for example, sovereign debt, commercial and residential mortgages, and corporate loans.

Involvement of blockchain technology

The involvement of blockchain technology in the tokenization of Real World Assets represents a significant evolution in the financial industry. Blockchain's integration into this space has been encouraged by several key factors.

-

Enhanced Liquidity: By tokenizing RWAs on the blockchain, these assets become divisible into smaller units, allowing for fractional ownership. This fractionalization increases liquidity by enabling investors to trade fractions of assets, thus expanding the pool of potential buyers and sellers. Additionally, blockchain-based trading platforms facilitate 24/7 trading, reducing barriers to entry and enhancing market efficiency.

-

Reduced Administrative Overhead: Traditional processes for issuing, trading, and managing RWAs involve substantial administrative burdens, including paperwork, intermediaries, and reconciliation processes. Blockchain technology streamlines these processes by automating tasks such as asset transfer, ownership verification, and transaction settlement through smart contracts. This automation reduces administrative overhead, eliminates intermediaries, and accelerates transaction times, resulting in cost savings and improved efficiency.

-

Increased Transparency and Security: Blockchain's decentralized and immutable ledger provides transparent and tamper-proof records of asset ownership, transactions, and historical data. This transparency enhances trust and confidence among market participants, as they can independently verify the authenticity and integrity of asset information. Additionally, blockchain's cryptographic security features protect against fraud, manipulation, and unauthorized access, safeguarding the integrity of asset transactions and data.

Due to these benefits offered by the on-chain tokenization of RWA, many traditional asset originators are considering on-chain financing for both strategic and fiduciary reasons, thus re-ledgering assets or issuing them natively on-chain.

Also, we have to note that although both tokenized funds and NFTs are a representation of ownership, they differ greatly in terms of basic implementation and use cases.

Case study of Franklin Templeton tokenized funds

Franklin Templeton is a subsidiary of Franklin Resources, Inc. that offers boutique specialization on a global scale.

The Franklin OnChain U.S. Government Money Fund is the first U.S. registered mutual fund to use a public blockchain to process transactions and record share ownership, with one share denoted by one BENJI token, i.e. they bought the bonds issued by the U.S. government, which are the RWAs here, and tokenized them on public blockchains like Ethereum and Polygon, with one BENJI token equivalent to one share of the RWA.

Although the Fund’s transfer agent will maintain the official record of share ownership in book-entry form, the ownership of the Fund’s shares will also be recorded on the blockchain network and in the event of a conflict between the blockchain record and the record held by the transfer agent, the transfer agent’s record will be determinative.

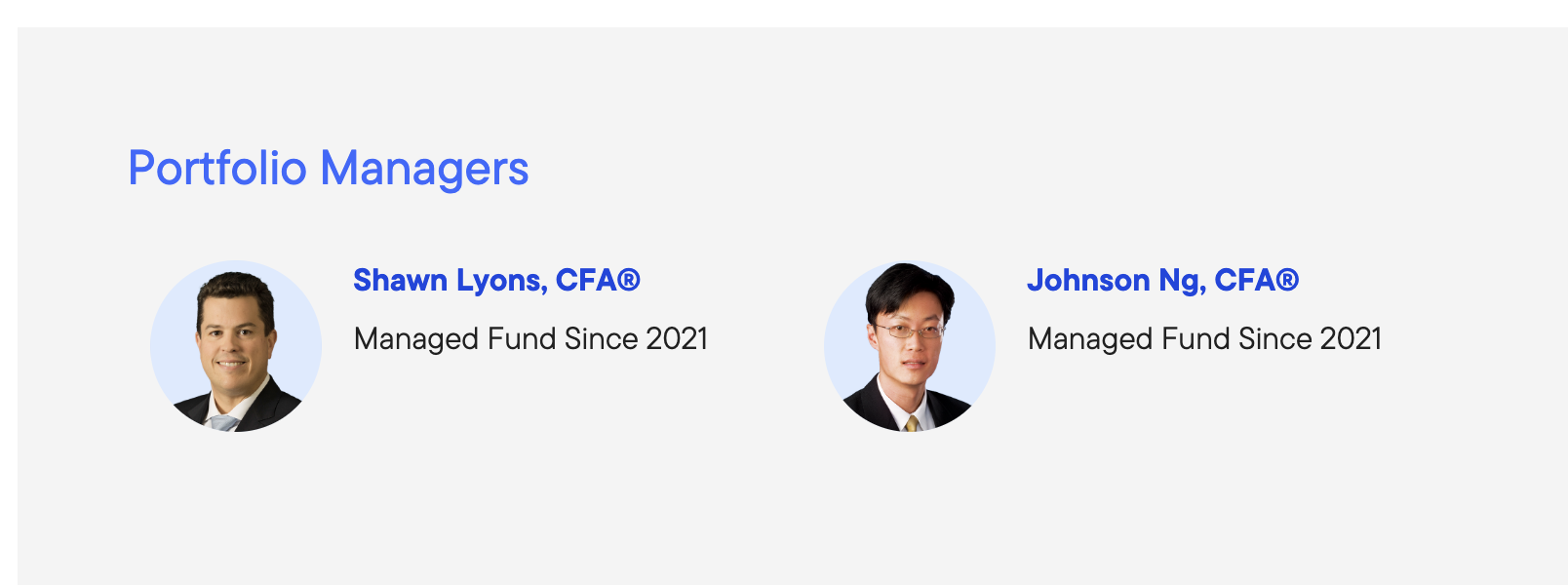

Referring to the website of the company, we see that there are two portfolio managers, Shawn Lyons and Johnson Ng.

Figure 1: Source: Franklin Templeton Website

Because the fund is new, it has no performance history. Once the Fund has commenced operations, you can obtain updated performance information by accessing the information through their App or website.

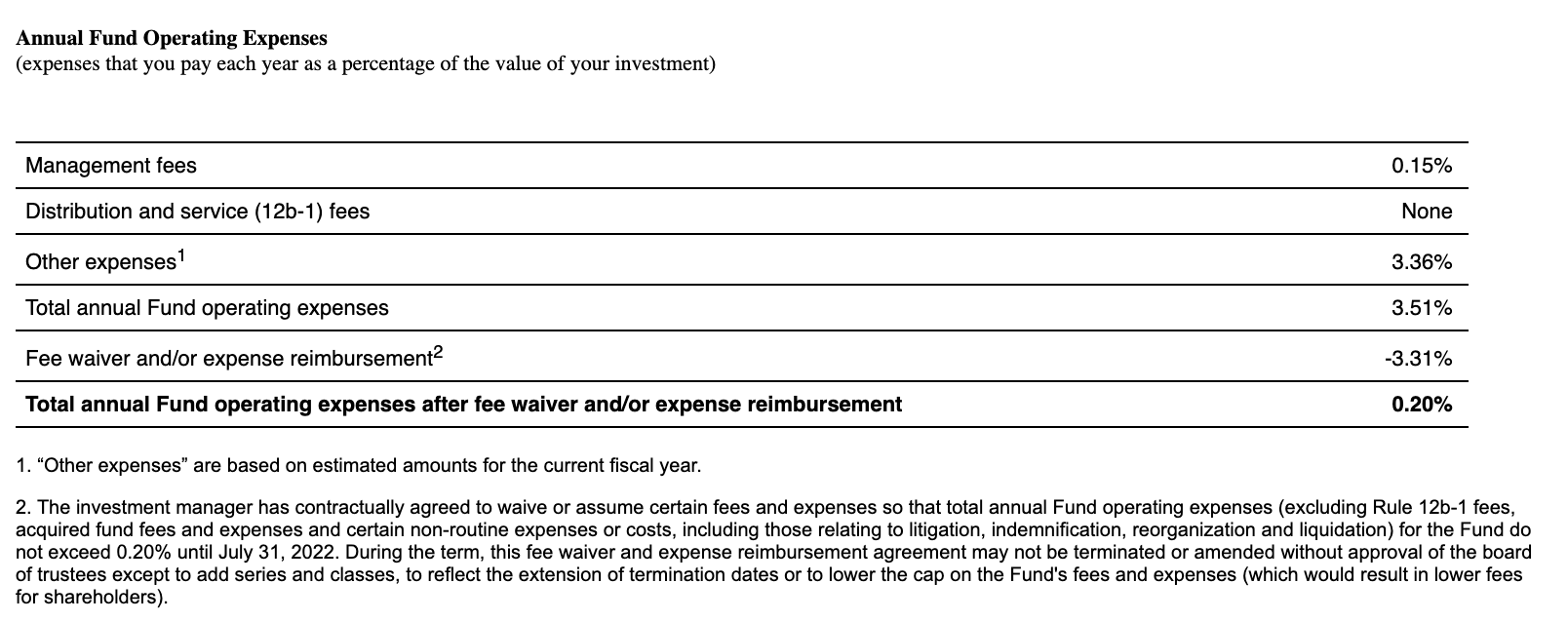

Here is a snippet for understanding the annual expenditure of the fund.

Figure 2: Source: sec.gov

The contract address of the BENJI token on Polygon Mainnet network is: “0x408a634b8a8f0de729b48574a3a7ec3fe820b00a"

We are running the following queries using Bitquerry APIs:

- To get some basic information about the token, such as name, symbol, decimal places and current matic balance, we are running the following query.

https://ide.bitquery.io/BENJI-token-info

query ($network: EthereumNetwork!, $address: String!) {

ethereum(network: $network) {

address(address: {is: $address}) {

annotation

address

smartContract {

contractType

currency {

symbol

name

decimals

tokenType

}

}

balance

}

}

}

{

"network": "matic",

"address": "0x408a634b8a8f0de729b48574a3a7ec3fe820b00a"

}

- Next we query the transaction details of the BENJI token smart contract.

https://ide.bitquery.io/BENJI-token-transactions

query ($network: EthereumNetwork!, $token: String!, $from: ISO8601DateTime, $till: ISO8601DateTime) {

ethereum(network: $network) {

transfers(

currency: {is: $token}

amount: {gt: 0}

date: {since: $from, till: $till}

) {

currency {

symbol

}

median: amount(calculate: median)

average: amount(calculate: average)

amount

count

days: count(uniq: dates)

sender_count: count(uniq: senders)

receiver_count: count(uniq: receivers)

min_date: minimum(of: date)

max_date: maximum(of: date)

}

}

}

{

"network": "matic",

"token": "0x408a634b8a8f0de729b48574a3a7ec3fe820b00a"

}

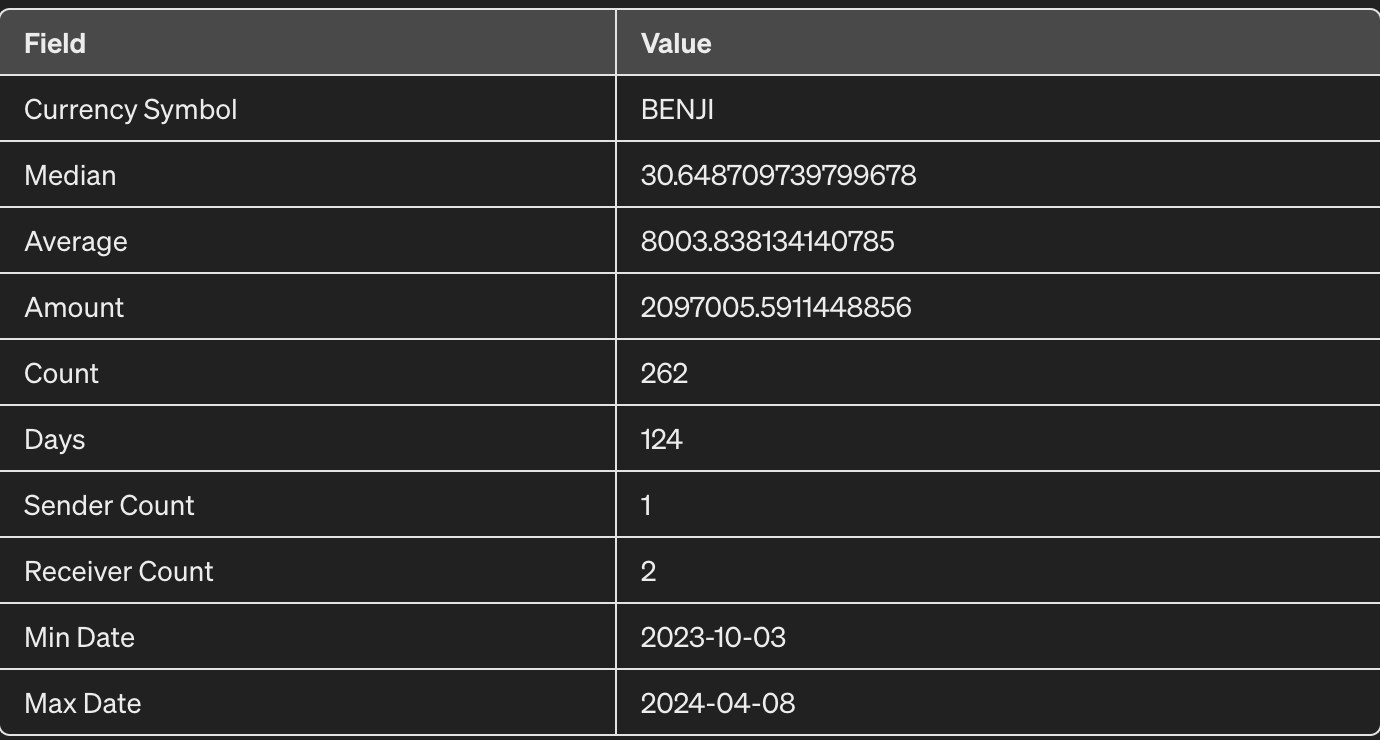

The result shown gives us some good insights of how the Franklin OnChain U.S. Government Money Fund functions and operates on the blockchain and also gives us an idea about the average size and count.

Figure 4: Result of second query(token transaction details)

From these results we have got some insights that are mentioned in the next section.

Insights from the token activity

Based on the query results shown above we can say that:

-

The number of unique senders is only one, which could be the issuer of the token, the address with the permission to mint, burn and distribute these BENJI tokens. This is a standard practice followed in most of the tokenization or token related projects.

-

One thing that stood out was that there were only 2 unique wallet addresses to which the tokens were sent. It is possible that it belongs to the portfolio team at Franklin Templeton.

-

Now, as for why the Polygon network is chosen it could be due to the reason that Polygon provides a layer 2 implementation over ethereum blockchain thus providing the security of ethereum along with additional speed and most importantly way less gas fee.

-

Getting to the numerical data, for the span of around 121 days with 256 transfer transactions the average transfer amount was around 8186 BANJI tokens however the median transfer amount was around 31 tokens.

Conclusion

With over $1B worth of U.S. treasury being tokenized and available for sale to common man in the form of tokens on blockchain, we could say tokenization is the need of the hour and Franklin OnChain U.S. Government Money Fund with its head start in the race is still leading as the biggest player of the space with around $360M from the total pool. An end user must know that these projects would continue to grow in future and should have some surface level knowledge of these projects, regardless of whether they invest in them or not.

Written by Kshitij Mahajan

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.