DEX Data Doesn’t Lie: Who's the Leader in DeFi Trading?

Many crypto commentators claim the BNB Chain (formerly Binance Smart Chain) is number one for decentralized trading. In this analysis, we dig into the on-chain DEX data to see what’s happening.

Is BNB Chain truly dominating decentralized exchange activity, or are those numbers driven by algorithmic “pump-and-dump” bots?

And if BNB isn’t the unquestioned leader in real trading, could Solana (with new platforms like Pump.Fun) be giving it a run for its money?

We compare key metrics – trading volume, transaction count, active traders, fees, and token launches between BNB Chain and Solana to set the record straight.

Suspected Bot Activity on BNB

There are clear signs that a significant portion of the BNB Chain’s DEX volume is driven by short, aggressive trading algorithms rather than broad retail demand. Traders and analysts have identified pump-and-dump cycles on BNB pairs, where bots rapidly buy a token to spike its price, lure in late buyers, and then quickly sell large positions seconds later. This yields spikes in volume and price, followed by equally sharp crashes, a pattern not characteristic of organic market behavior. In practice:

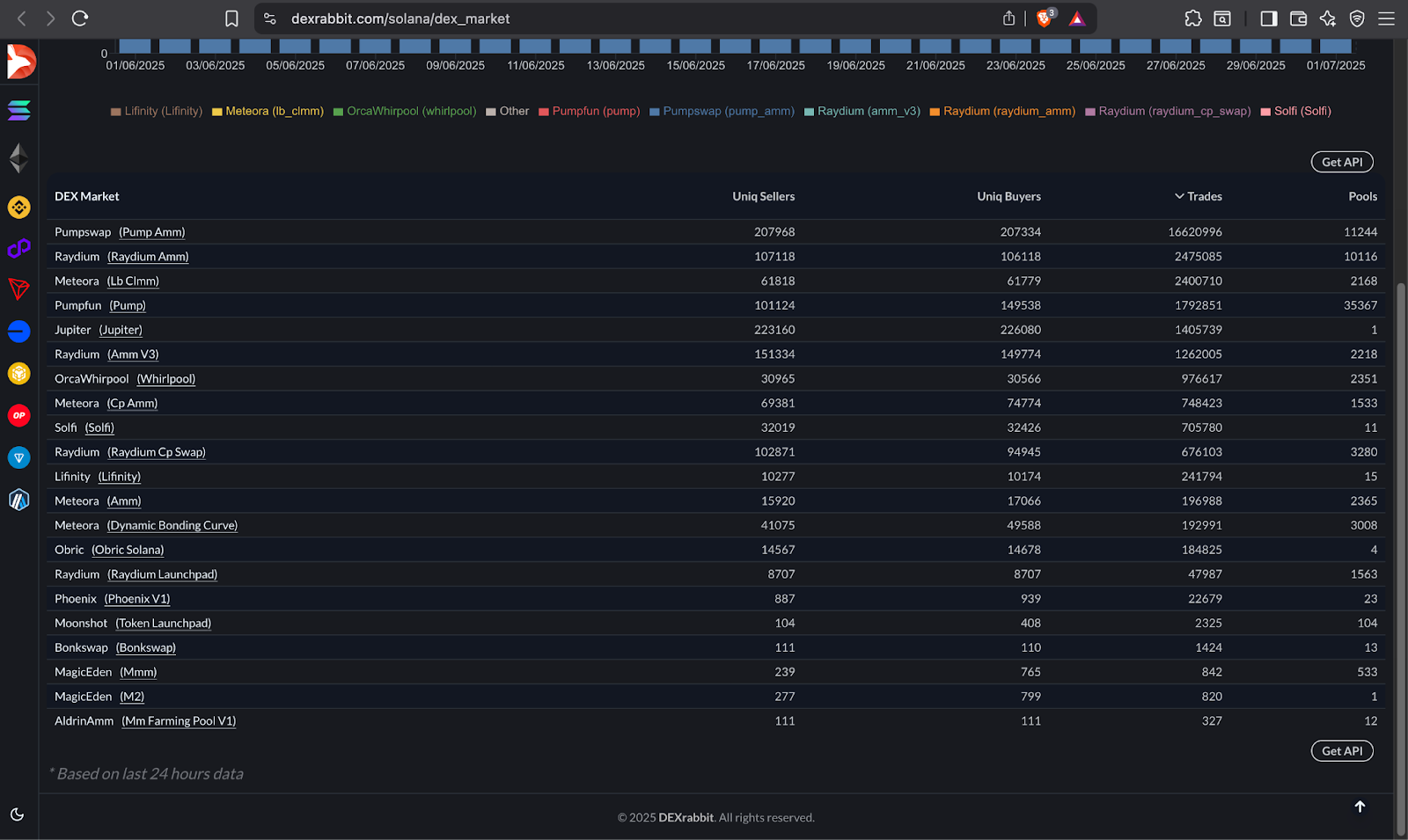

- Bots buy aggressively: Automated scripts scoop up a token very fast, pushing the price up. You can check top pairs randomly on a trade data site like DEXRabbit.

- Retail FOMO kicks in: Seeing the sudden jump, ordinary traders buy in, fearing they’ll miss out.

- Bots dump & profit: The bots then sell at the inflated price, causing a steep price drop.

- Cycle repeats: Minutes later, the same routine often starts again on either the same token or another.

This pattern, huge volume bursts followed by dumps, shows up repeatedly in on-chain data for new BNB tokens. The two example DexRabbit charts (BNB pair links provided) illustrate exactly this behavior. It suggests that a lot of BNB DEX volume is from a small number of bots running automated pump schemes, rather than from broad, genuine trading.

This kind of behavior, high-volume bursts created by bots rather than real users, raises an important question: If much of BNB’s activity is artificial, how does it compare to a chain like Solana, which is known for attracting broader community-driven participation? To answer that, we need to move beyond volume headlines and dive into real metrics like trade counts, active users, and token diversity. Let’s put BNB and Solana side by side to see which chain is truly leading in decentralized trading.

BNB vs Solana – DEX Volume and Trades

To compare chains fairly, we look at multiple metrics. First up is trading volume (USD) on DEXs:

24h DEX Trading Activity

At the time of writing, we analysed the trading stats for the past 24 hours. Solana had about 12 million trades, and BNB at 9 million trades. The numbers look close enough at scale, but that’s not our concern; What if the numbers were made up of bots?

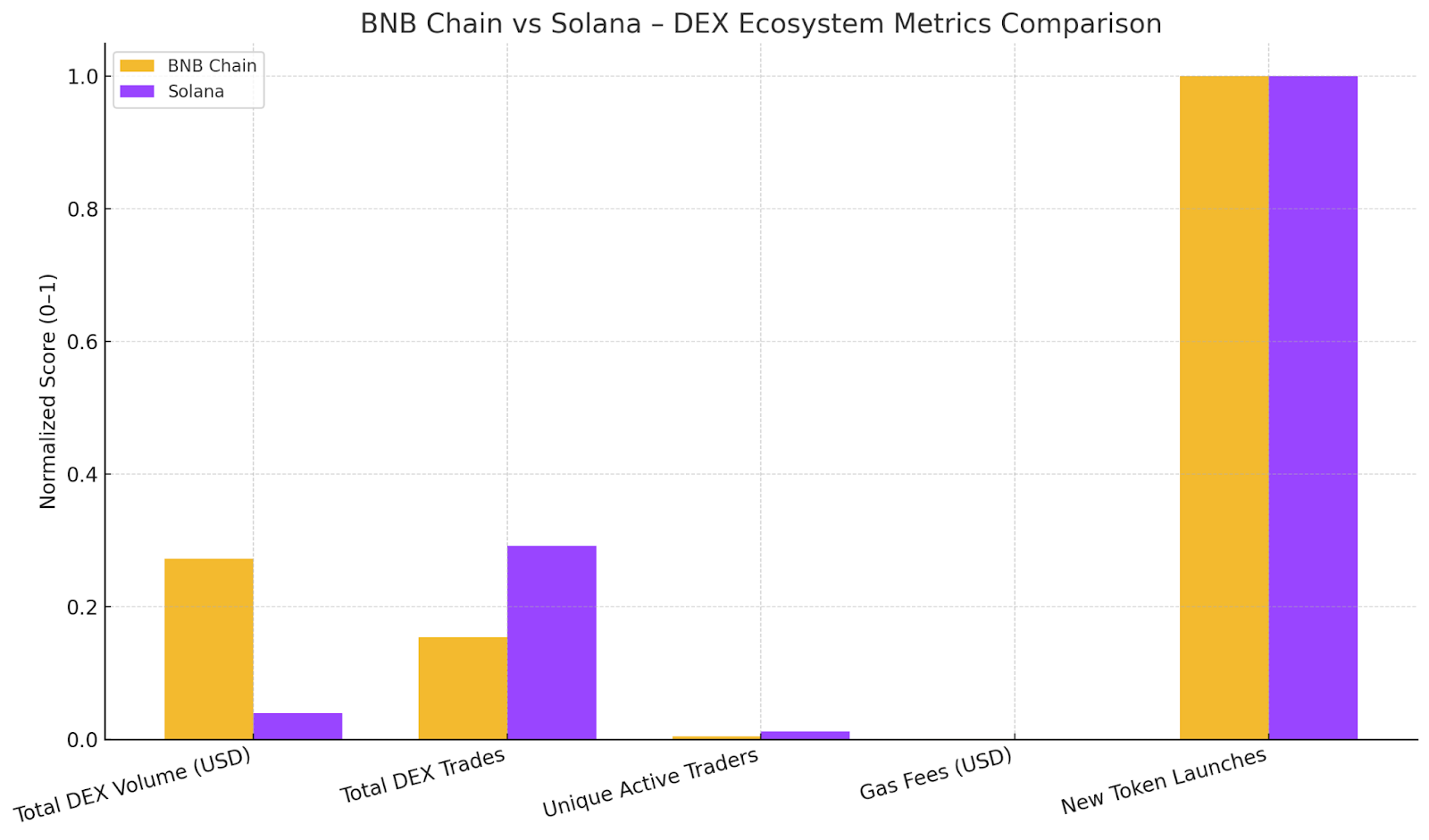

The BNB Chain shows an enormous total volume ( $17.7 billion in our snapshot), far above Solana’s ($3.8 billion). At first glance, BNB appears to be looking far ahead. However, BNB’s numbers are heavily concentrated in a few tokens (for example, USDT and newly launched coins like Bedrock dominated the BNB volume data). Many of those trades on BNB are the rapid pump-and-dump trades mentioned above. In contrast, Solana’s volume is more evenly spread across tokens like WSOL, USDC, and USDT, as well as a host of meme coins. The chart’s logarithmic scale highlights that while BNB’s raw volume is higher, Solana still has substantial multi-billion-dollar activity.

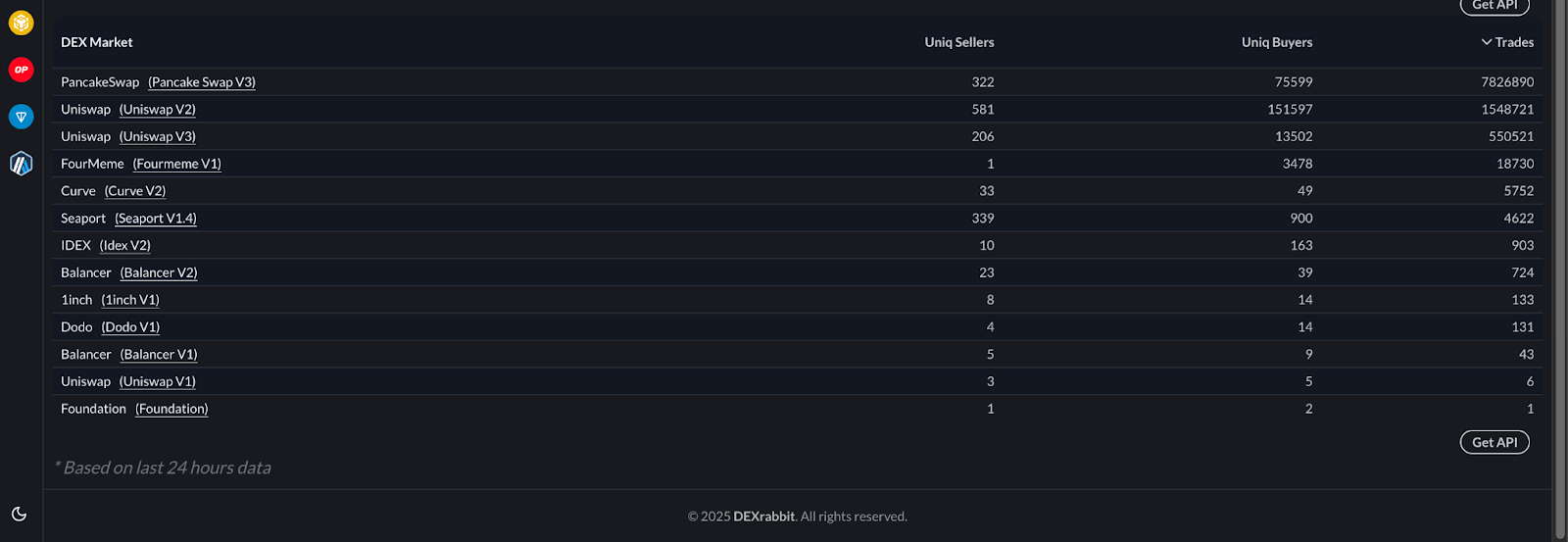

DEX transaction count (Number of trades executed):

Solana leads by a wide margin here: roughly 28.6million trades vs about 10.0 million on BNB in the same period. In other words, Solana saw almost three times as many individual DEX transactions as BNB Chain. This huge difference suggests Solana has far more granular trading activity.

A key contributor to Solana is PumpFun (a new “pump”-style DEX); it alone handled around 1.8 million trades in the period, drawing many participants into quick pump/dump games on that network. BNB’s DEX trades, by contrast, appear more dominated by large single trades (often bot-driven). Even PancakeSwap V3, BNB’s largest DEX, saw under 8 million trades. This implies that real, distributed trading activity is higher on Solana.

Active Traders and Fee Environment

Another lens is unique active traders. How many distinct addresses are buying on DEXes? Summing across all BNB DEXes, we observe ~264,000 unique buyers in our sample period, compared to about 1,108,000 unique buyers on Solana. Put differently, Solana engaged roughly four times more unique participants on DEXes than BNB Chain. A more active trader base on Solana suggests its ecosystem is hosting more genuine retail and programmatic trading.

Unique Active Buyers

This compares the two networks’ buyer counts. Solana’s bar towers over BNB’s, reinforcing that Solana’s DEXes have far more individual traders. (For reference, Solana’s top DEXes are Raydium, Meteora, and PumpFun, each reported large counts of unique buyers; on BNB PancakeSwap had ~84.9k, and other DEXs added up to ~264k total.)

One reason for Solana’s higher participation is its fee structure. Solana’s fees are tiny (often a fraction of a cent per swap), whereas BNB Chain fees, though low, are still on the order of a few cents per trade. BNB Chain recently announced an upgrade that lowers fees to as little as $0.005 per swap, but even that is higher than Solana’s fees. Lower gas costs on Solana make it more attractive for high-frequency memecoin speculators and small trades, the very crowd fueling these DEX numbers. (Less friction means more trades per user.) Thus, many of Solana’s traders are smaller-time or meme participants, whereas BNB’s numbers are boosted by a handful of very large-volume bot trades.

Meme Tokens and New Launches

Both chains are seeing a fever-pitch creation of new meme tokens and liquidity pools. The number of new tokens being launched and traded is huge on both sides, especially in the $1–10M range that pumps bots target.

On BNB Chain, our data showed dozens of new tokens with crazy price swings (e.g., Sahara AI, Roam Token, etc.), often traded against WBNB and USDT.

On Solana, hundreds of new “pumpcoins” (like Fartcoin, Mori, StupidCoin, etc.) are listed on niche DEXes or liquidity pools. Overall, BNB may have more total tokens created (given its longer presence), but the rate of new launches on Solana’s newer DEXes is very high. Both ecosystems are littered with tokens that exist mainly to supply speculative trading volume.

Note: The chart uses normalized scores (0 to 1) to fairly compare different metrics like volume, fees, and user activity, so you can easily see which chain performs better in each category, regardless of the original units

Conclusion

The idea that BNB Chain is the undisputed No.1 DEX trading chain doesn’t quite hold up under scrutiny. Yes, BNB’s raw DEX volume is larger, but much of it comes from rapid bot-driven cycles on a handful of tokens. Solana, by contrast, shows far more trades and far more unique traders, indicating broader participation. In other words, Solana seems to be winning the ecosystem engagement contest, even if its total dollars traded lag.

In practical terms, if you measure “No.1” by headline volume figures, BNB still looks on top, but automatic pumps inflate that. If you measure by real activity and trader count, Solana leads. The reality is nuanced: both chains are currently hotbeds of speculative token activity. The key takeaway is that high-volume DEX stats can be misleading, and claims like “BNB is No.1” should be taken with a grain of salt. In the end, the data suggests BNB’s lead may be largely an illusion of bots, while Solana’s DeFi scene has more genuine hustle and bustle under the hood.

The information provided in this material is published solely for educational and informational purposes. It does not constitute a legal, financial audit, accounting, or investment advice. The article's content is based on the author's own research and, understanding and reasoning. The mention of specific companies, tokens, currencies, groups, or individuals does not imply any endorsement, affiliation, or association with them and is not intended to accuse any person of any crime, violation, or misdemeanor. The reader is strongly advised to conduct their own research and consult with qualified professionals before making any investment decisions. Bitquery shall not be liable for any losses or damages arising from the use of this material.

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.